This past month, the real estate market update February 2024 in Northern Virginia has been vibrant. More homeowners put their properties up for sale in the new year. This happened as the holiday season came to an end, the new year began, and mortgage interest rates fell. With mortgage interest rates now around 6.9% , it is highly anticipated that rates will continue to slowly go down over the coming months. This is great news for homebuyers and home sellers.

The Department of Labor Statistics released the new Consumer Price Index (CPI) report stating that the inflation rate is now 3.1%. This is down only 0.3% from last month. There will be one more CPI report on March 12th before the Federal Reserve announces the federal funds rate on March 20th. In Northern Virginia, inventory spiked 70% between December 2023 and January 2024. Mortgage interest rates hover between 6.1% and 6.9%. The market activity is picking up with more homes for sale, more buyers looking for homes, and more mortgage applications. Here what this all means for the Northern Virginia real estate market update for February 2024.

Statistics and What it Means

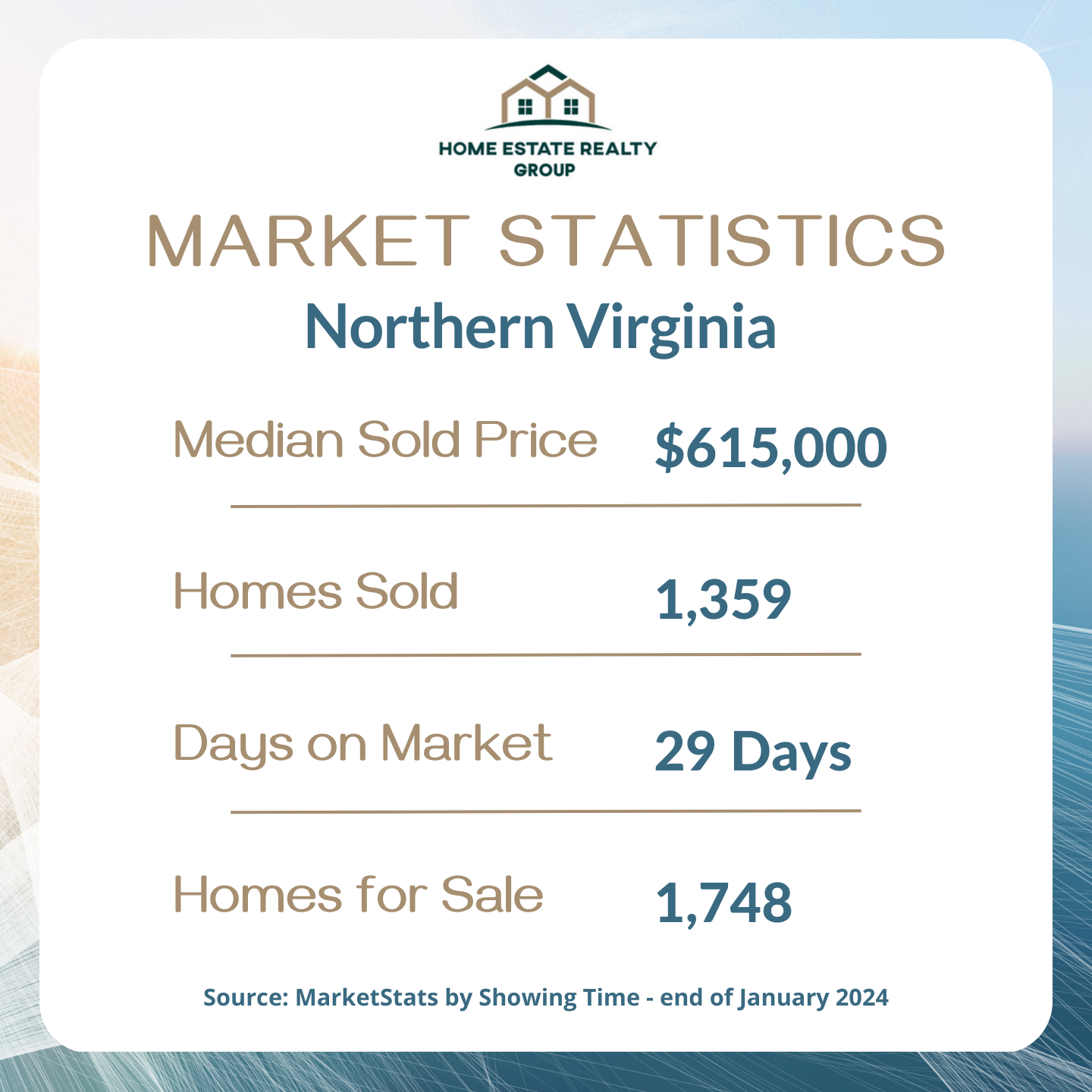

Using statistics from MarketStats by ShowingTime, we looked at 10 counties in Northern Virginia – Alexandria, Arlington, Fairfax, Falls Church, Fauquier, Loudoun, Manassas City, Manassas Park City, and Prince William. Here are the highlights for Northern Virginia.

The median sale price for a home in Northern Virginia is now $615,000, which is about the same as the previous month and up 7% from this time last year.

At the end of January 2024, there were 1,359 homes sold in Northern Virginia. This is down 16% from the previous month and up 0.7 % from last year. This speaks to the low number of homes that went on sale in the slow months of November and December.

The number of Days on Market for Northern Virginia is now 29 days, which is 5 more days than last month and the same from this time last year.

This month, there are 1,748 homes for sale. This is down about 4% than last month and down about 20% from last year. Additionally homes sold at 98.9% of the original asking price. In general, home owners are getting close to their asking price. Keep in mind that these figures vary depending on the city and neighborhood of your home.

Inventory Levels

The phrase “Month’s Supply” refers to how many months it will take to sell all the homes currently on the market. Most consider a balanced market, where buyers and sellers are on the same playing field, to be about 3-6 months supply. Currently, Northern Virginia has a month’s supply of homes for sale of 1.3; this is up from 1:1 from last month.

Bright MLS Buyer Demand Index

According to Bright MLS Home Demand Index, buyer demand in the Washington Metro Area (which includes Northern Virginia) remains “Limited”. The Bright MLS | T3 Home Demand Index measures and tracks consumer and real estate professional behavior related to shopping for real estate. They look at metrics such as the number of views of homes online and in-person showings. Ratings are categorized into 5 score points: Limited (under 70 points), Slow (70-89), Steady (90-109), Moderate (110-129), and High demand (over 130).

This month, buyer demand is LIMITED across most areas and may be due to the winter season. Here are the top 5 in Northern Virginia: MODERATE in Arlington (118); SLOW in Alexandria City (82), Falls Church (82), and Prince William (75); and LIMITED in Winchester (66). Loudoun County’s buyer demand is LIMITED at (54).

What to Expect in the Coming Month

As anticipated, the real estate market is slowly gaining more inventory. Inflation continues to be a problem and thus mortgage interest rates are expected to stay around 6.5% for now. The good news is that home prices remain strong in Northern Virginia, with homes up in value 7% from last year.

Advice to Sellers

For homeowners in Northern Virginia, accurate pricing and good condition remain crucial ingredients to ensure a smooth and successful sale. If done properly, expect to get close to your original list price and go under contract in about 3 weeks.

Advice to Buyers

Lower interest rates mean higher buying power and more affordability. If you were thinking to buying, this is the time to prepare by checking credit score and evaluating savings needed for closing.

Bottom Line

The market update for February 2024 shows a more vibrant real estate market.

Questions/Concerns? Please contact me

Denise Fuller, Real Estate Specialist

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link