Even as the federal government shutdown extends into its third week, the Northern Virginia housing market continues to show signs of resilience and shifting trends. The latest housing data covers all 10 counties across the region, offering a clear picture of what’s happening locally as buyers and sellers adapt to ongoing changes.

Market Overview: Prices and Sales Activity

The median sold price in September was $769,000, reflecting a 2.3% decrease from August, but still up 2.1% from last year. While the month-to-month decline suggests a cooling phase, year-over-year growth continues to demonstrate the region’s long-term strength.

A total of 2,631 homes were sold in September, marking a 10% drop from August, yet a 7.6% increase compared to last year. Homes are taking slightly longer to sell, with average days on market reaching 27 days—two days longer than August and seven days longer than the same period in 2024.

Inventory Growth and Pricing Balance

At the end of September, 4,518 homes were actively listed for sale, representing a 5% decline from August, but a substantial 40% increase over last year. This rise in available inventory is giving buyers more options and contributing to a healthier balance between supply and demand.

The original list price to sold price ratio stood at 98.2%, only slightly below last month’s figure and down 1% from last year. While this shift is minimal, it indicates that sellers may need to adjust pricing expectations in a market where buyers have more choices.

Economic Factors: CPI, Fed Meetings, and Mortgage Rates

Despite the challenges of the federal shutdown, key economic data remains on track—though delayed. The Consumer Price Index (CPI) report has been postponed to September 24, as government agencies work with limited staffing. Following that, the Federal Reserve’s next policy meeting is scheduled for October 28–29, with a possible announcement on rate adjustments expected on the 29th.

Many analysts anticipate that the Fed may lower the federal funds rate by 0.25%, although uncertainty remains due to the ongoing shutdown. These decisions play a major role in determining the direction of mortgage interest rates, which directly impact home affordability.

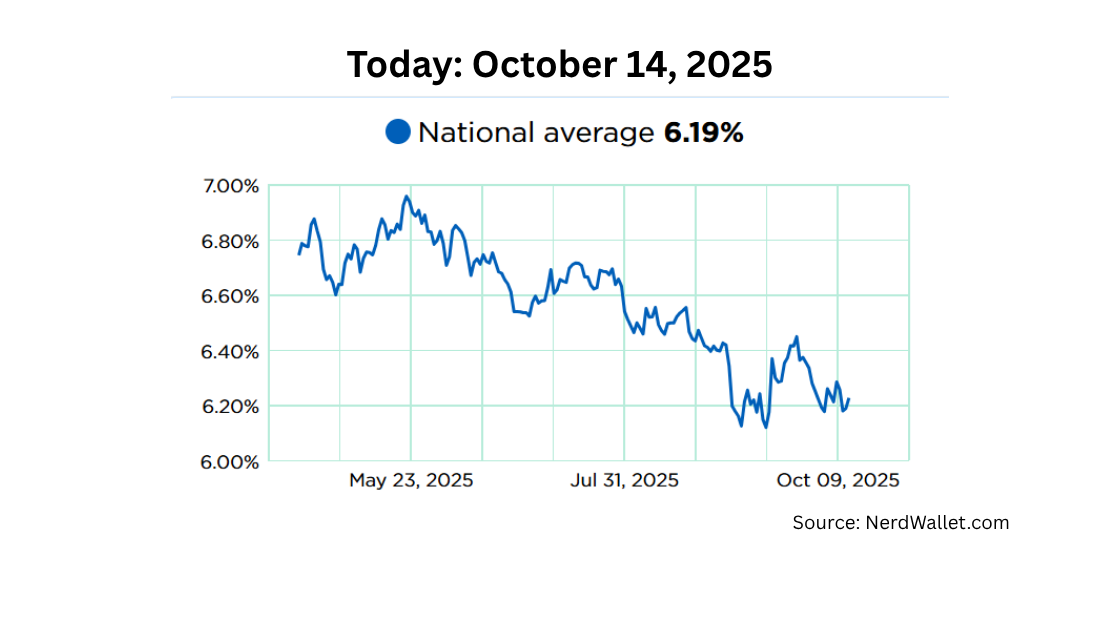

Mortgage Rates Trend Downward

One of the most encouraging developments for homebuyers is the continued decline in mortgage interest rates. The national average for a 30-year fixed mortgage recently fell to 6.1%, compared to 6.7% just six months ago. This trend is improving affordability, allowing buyers to qualify for higher-priced homes while keeping monthly payments manageable.

Market Sentiment: Optimism Despite Uncertainty

Even with the challenges surrounding the federal shutdown and economic data delays, buyer activity remains strong. Increased inventory and lower rates are drawing more shoppers back into the market. Open houses are seeing healthy turnout, and both agents and consumers report a sense of optimism as fall progresses.

While overall numbers may appear modest, market momentum remains steady, fueled by affordability gains and pent-up buyer demand. As long as interest rates continue their downward trend and inventory remains healthy, Northern Virginia’s housing market is positioned for a stable finish to the year.

Final Takeaway

Despite the uncertainty of federal operations, Northern Virginia’s real estate market continues to move forward with encouraging indicators. Inventory growth, modest pricing adjustments, and improving mortgage rates are creating new opportunities for both buyers and sellers heading into the final quarter of the year.

BOTTOM LINE

As always, real estate remains a local business. For those considering a move, strategic preparation and market insight are key to making the most of this evolving summer season.

Questions/Concerns? Please contact me.

Denise Fuller, Real Estate Specialist

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link