The current real estate market in Northern Virginia is exciting. Mortgage rates are coming down. Today, the Federal Reserve announced they will lower the federal funds rate by half a percent. This will allow rates to go even lower than today’s rate of 5.7%. This is great news for anyone thinking of buying a home or refinancing their mortgage. The Federal Reserve based the decision on the fact that levels of inflation are continuing to go down. The consumer price index (cost of goods and services) is now down to 2.5%, which is so close to the goal of 2%. Additionally, the latest real estate market data for September 2024, shows that home prices remain stable while it’s taking longer for homes to go under contract. Here is the Market Update for September 2024.

Consumer Price Index News

The latest Consumer Price Index (CPI) report for the end of August 2024 showed inflation (the cost of goods and services) increased 2.5% over the last year. This is down from 2.9% reported at the end of July 2024. This is great news as it’s that much closer to the 2.0% goal set by the Federal Reserve.

ederal Reserve Announcement

Today, the Federal Reserve announced that they have reduced the federal funds rate down by half a point. This is the first rate cut in 4 years. This means that we can look forward to lower mortgage interest rates in the days to come.

Mortgage Interest Rates

Today, even before the Federal Reserve announcement, mortgage interest rates are at 5.723%. This is the lowest it’s been since June 2022 when the federal reserve was steadily increasing the federal funds rate to combat a 9% inflation rate. Rates during this 2year period were as high as 8%, the highest in 20 years. This caused the housing market to slow considerably though home prices didn’t go down significantly in every area.

Statistics and What it Means

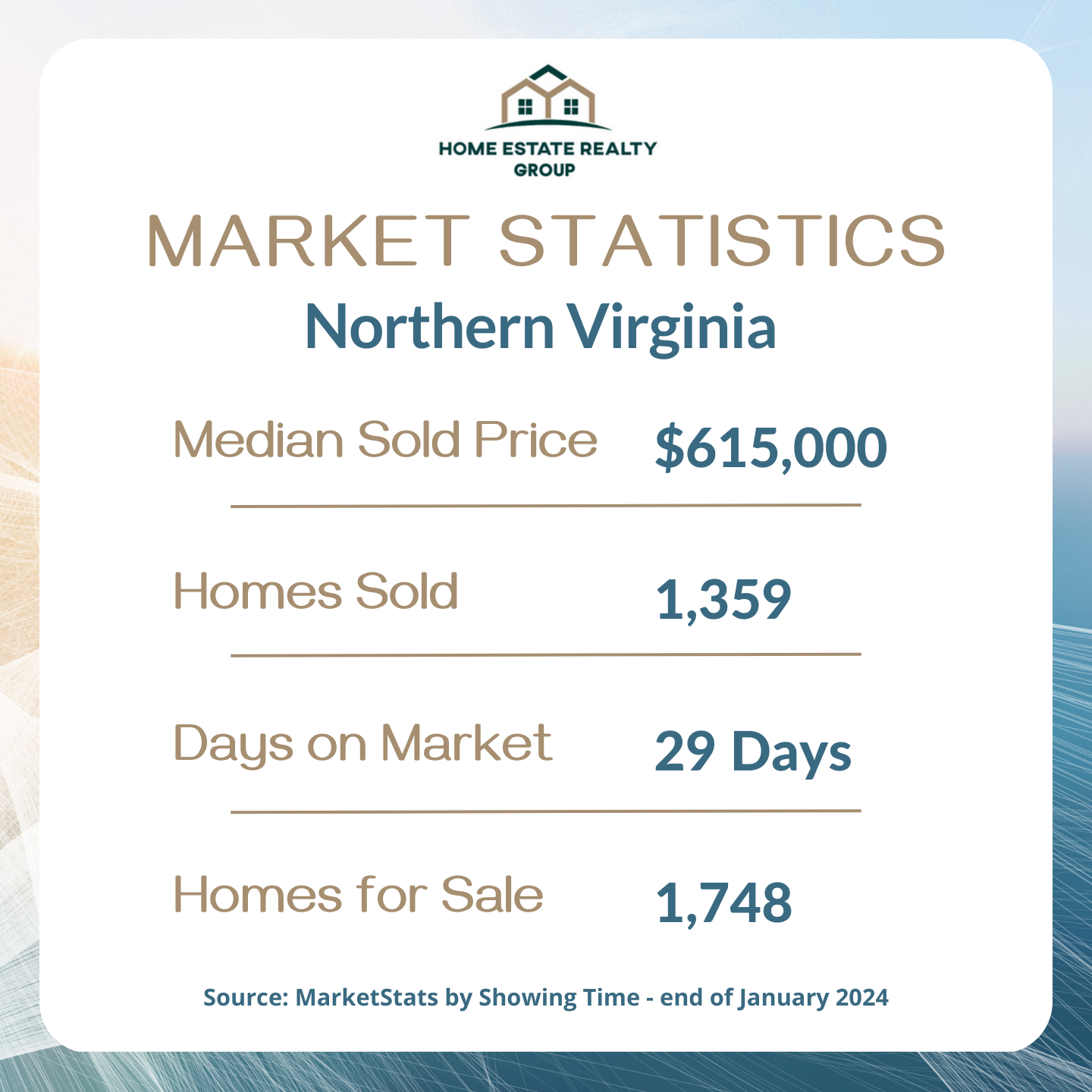

Using statistics from MarketStats by ShowingTime, we looked at 10 counties in Northern Virginia – Alexandria, Arlington, Fairfax, Falls Church, Fauquier, Loudoun, Manassas City, Manassas Park City, and Prince William. Here are the highlights for Northern Virginia.

The median sale price for a home in Northern Virginia in the month of August was $686,750, which is about the same it was last month and up 5/5% from last year.

At the end of August 2024, there were 2,522 homes sold in Northern Virginia. This is down 10% from the previous month and down 2.6% from last year. Though interest rates were under 7%, it seems buyers were in no hurry as hoes also took longer to go under contract.

The number of Days on Market for Northern Virginia is now 17 days, this is 2 days more than last month and 1 day more than last year. It is taking a little longer to get homes under contract.

This month, there are 3,106 homes for sale, which is a 3.5% increase from last month and 17% increase from last year. Additionally homes sold at 99.7% of the original asking price. In general, home owners are having to negotiate prices.

Inventory Levels

The phrase “Month’s Supply” refers to how many months it will take to sell all the homes currently on the market. Most consider a balanced market, where buyers and sellers are on the same playing field, to be about 3-6 months supply. Currently, Northern Virginia has a month’s supply of homes for sale of 1 month. This indicates that though inventory is improving, we do need homes to go on sale to meet the demand.

Bright MLS Buyer Demand Index

According to Bright MLS Home Demand Index, buyer demand in the Washington Metro Area (which includes Northern Virginia) remains “Limited”. The Bright MLS | T3 Home Demand Index measures and tracks consumer and real estate professional behavior related to shopping for real estate. They look at metrics such as the number of views of homes online and in-person showings. Ratings are categorized into 5 score points: Limited (under 70 points), Slow (70-89), Steady (90-109), Moderate (110-129), and High demand (over 130).

This month, buyer demand is SLOW across most areas. Here are the top 5 in Northern Virginia: MODERATE in Alexandria (116); STEADY in Arlington (108) , Prince William (108), and Stafford (96); and SLOW in Manassas City (89). Loudoun County’s buyer demand is SLOW (78).

What Does This All Mean

The real estate market has been slow as summer comes to an end. Currently homes are holding their values and also taking a little longer to go under contract. Still, inventory is low so home sellers are assured a solid sale while home buyers can expect some areas where they are able to negotiate. With the Fall season and the recent decrease of the federal reserve funds, it is expected that more home buyers will enter the arena and home sellers will be more likely to list their homes. Only time will tell.

Advice to Sellers

For homeowners in Northern Virginia, accurate pricing and good condition remain crucial ingredients to ensure a smooth and successful sale. If done properly, expect to get your asking price and go under under contract in about 2-3 weeks. The coming months will be about preparation, preparation, preparation. Don’t do this alone. Get expert advice on what are the most urgent projects to tackle that will reap you the most rewards. If you need advice, please reach out. With more activity this Fall, it’s a great time to get your home on the market.

Advice to Buyers

This is not the time to wait for better rates. Work with a professional lender to determine your budget and then begin your search. Our advice is to lock in a great rate and ensure your lender can always lower the rate before your loan is approved. Has anyone taken the time to explain the home buying process with you? If not, please reach out.

Related Video

Bottom Line

The market update for September 2024 shows stable home prices, still lower inventory, and more buyer negotiations. As mortgage interest rates continue to go down, more home buyers are sure to want to start shopping and more home sellers will make the decision to upgrade their lives. We look forward to keeping you informed every step of the way.

Questions/Concerns? Please contact me

Denise Fuller, Real Estate Specialist

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link